Currency Risks Associated with Aviation Businesses

Currency risk is a well-known challenge that can have a significant impact on international aviation companies. Fluctuations in exchange rates can affect revenue, expenses and profitability, creating financial risks.

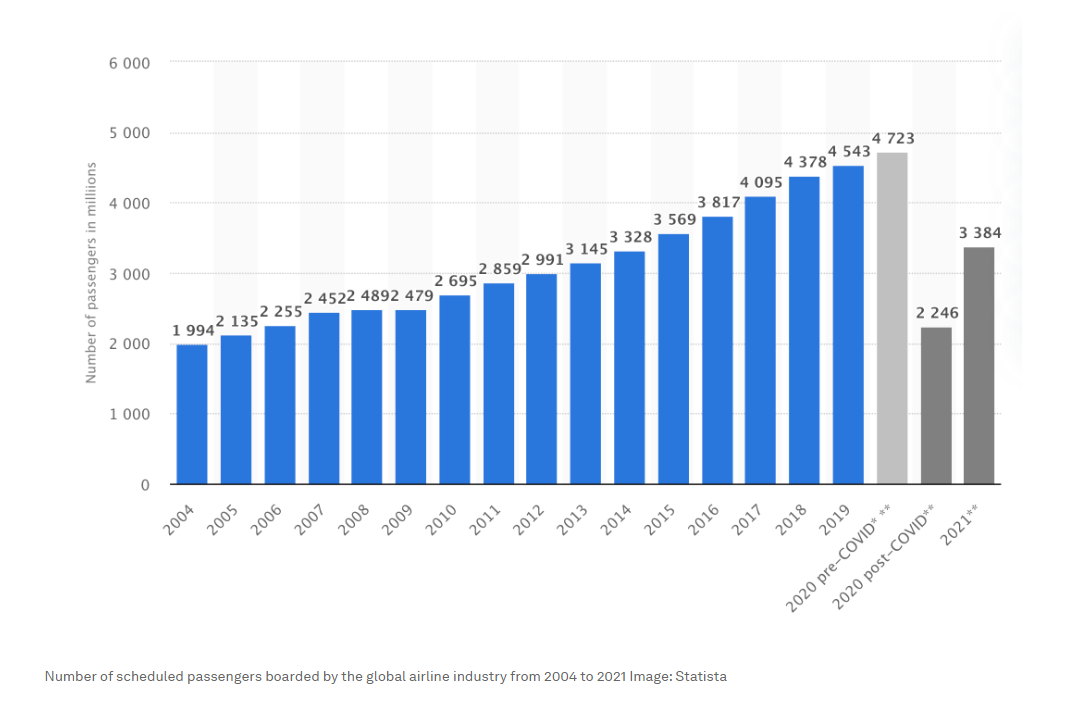

The COVID-19 pandemic had a significant impact on the sector and resulted in a sharp decline in air travel due to cancellations and travel restrictions.

Given some of the risk associated with the sector, obtaining competitive credit facilities for currency hedging can sometimes prove to be challenging for companies.

Some of the currency risks that aviation companies face are below.

Aircraft Purchase and Leasing

Aviation companies often enter into agreements to purchase or lease aircraft and services from foreign manufacturers, lessors, and maintenance providers. Fluctuations in exchange rates between currencies can affect the cost of these agreements, potentially impacting the company's profitability and financial position.

Crew, Maintenance and Insurance Costs

Maintenance, repair and insurance costs for aircraft services can also be affected by changes in exchange rates. This is particularly true for aviation companies with wet lease agreements (leasing an aircraft with cabin crew and aircraft maintenance and insurance). When the local currency of a company weakens in comparison to the currency of the costs associated with maintenance, repair, and insurance services in another country, the resulting increase in these costs can potentially reduce profitability.

Fuel

Fuel expenses are a significant cost for airlines, and the cost of fuel is typically priced in U.S. dollars. If a business’s domestic currency weakens against the U.S. dollar, it could result in higher fuel costs, negatively impacting their profitability.

Revenue

Revenue generation by aviation companies through the likes of ticket sales in foreign currencies can also be affected by fluctuations in exchange rates. Additionally, companies with subsidiaries in foreign countries may be exposed to currency risk, as changes in exchange rates can impact the profitability of these subsidiaries.

Financing

Aviation businesses may also be exposed to currency risk through financing activities, such as borrowing funds in a foreign currency to finance operations or aircraft purchases/leases. Fluctuations in currency values can affect the value of repayments or interest payments in foreign currencies.

Ways to Mitigate Risks

The currency risks aviation companies face can be mitigated with hedging strategies that involve products, such as forward contracts or options. Forward contracts allow a company to lock in an exchange rate for future transactions and options (derivatives) can offer protection against adverse currency movements whilst providing the “option” to participate in favourable movements. Additionally, methods such as hedging programs can provide companies with a rolling buffer should adverse currency movements occur.

Download our aviation guide for more information below.

Centura FX has a wealth of experience in assisting aviation companies to develop and implement effective currency risk management strategies. As a specialist in foreign exchange, we can offer a range of products and flexible hedging facilities to mitigate our client’s FX risk.

You can arrange a call with one of our specialists or contact us directly by calling 0203 871 9830.